Start Your Free Zone Company Setup In Dubai

Planning a Free Zone company setup in Dubai? Enjoy 100% ownership, streamlined approvals, and flexible visas, ideal for startups and SMEs. Our team manages licensing, banking, and compliance end-to-end. Let’s walk through the process.

Setting Up Businesses in Dubai’s Free Zones

Setting up in a Dubai Free Zone is a proven route for entrepreneurs expanding in the UAE. With 100% foreign ownership, fast licensing, modern infrastructure, and flexible office options, you can launch quickly and scale confidently. Choose from 30+ specialized Free Zones, from trade and logistics to tech and media, each offering tailored support. Free Zones also provide full profit repatriation and tax efficiency: 0% corporate tax on qualifying income if QFZP conditions are met (9% on non-qualifying), and no personal income tax. We’ll guide you step by step so your setup is smooth, bank-ready, and compliant.

Why Choose a Dubai Free Zone for Your Business?

Regarding business setup in Dubai Free Zone, the advantages are plenty. Dubai has over 30 Free Zones, each offering specific benefits based on your business activity.

Dubai Free Zone Licensing Costs (IFZA, DMCC, RAKEZ, DWTC, SPCFZ)

Pricing varies by zone, activity, visa quota, and workspace. Use these indicative entry points to plan; we’ll confirm live fees before you commit.

| Free Zone | Typical entry “from” | Visa notes | Workspace | Typical timeline |

|---|---|---|---|---|

| IFZA (Dubai) | AED 12,900 (0-visa) | Add visas as needed | Flexi / Co-working / Office | Few working days |

| DMCC (Dubai) | AED 35,000+ | Visa allocation by office | Flexi / Co-working / Office | 1–3 weeks |

| DWTC (Dubai) | By quotation | By package/office | Co-working / Office | 1–3 weeks |

| RAKEZ (RAK) | AED 6,000–16,500 | Packages with visa options | Flexi / Co-working / Office | 1–2 weeks |

| SPC Free Zone (Sharjah) | AED 5,750+ | Visa packages available | Flexi / Co-working / Office | Same day–few days |

Notes: Fees exclude 5% VAT and third-party costs (medicals, Emirates ID, attestations). We’ll itemise inclusions in your quote.

QFZP / Corporate Tax at a glance: Free Zones can offer 0% corporate tax on qualifying income if you meet QFZP conditions (substance, audited FS, TP, de-minimis). Non-qualifying income is taxed at 9%. We assess and maintain eligibility for you.

Trading on the UAE Mainland from a Free Zone

Free Zone companies can trade internationally and within their zone. To sell directly on the UAE mainland, you typically:

- Work with a licensed mainland distributor (service agreement + VAT).

- Open a mainland branch or civil company for direct invoicing.

- For e-commerce, use approved last-mile partners and comply with VAT/customs.

We’ll map the lowest-friction route based on your model and margins, and connect this page to your Mainland services for a smooth upgrade path

Step-by-Step Free Zone Company Setup ( 1–3 weeks)

Understanding the steps is key to a smooth Free Zone company setup in Dubai. Here’s a simple guide to get you started.

Step 1: Choose the Right Free Zone

We begin with a personal meeting to understand your needs and explain the will preparation process in Dubai. Every family is different, and we take the time to listen.

Step 2: Define Your Business Activity

Choosing the right activity helps you get the correct Free Zone license in Dubai. Options include consultancy, trading, manufacturing, and many more.

Step 3: Select Your Company Name

Pick a trade name that aligns with your brand and complies with the UAE naming guidelines. This is a crucial part of your Dubai Free Zone company formation.

Step 4: Prepare and Submit Documents

Gather the required documents like passport copies, application forms, and business activity details. Timely submission ensures faster processing.

Step 5: Get Your Business License

Once approved, you’ll receive your Free Zone license in Dubai, allowing you to operate and start trading legally.

Step 6: Apply for Visas

Free Zones allow you to apply for investor and employee visas, making building your team and managing operations locally easier.

Free Zone License Types in Dubai

Pick the license that matches what you sell and how you deliver it. The right choice affects approvals, banking, visas, and even warehouse/office needs. (Direct mainland sales typically require a local distributor or a mainland entity.)

Commercial / Trading License

Sell, import/export, and distribute physical goods.

Best for: general trading, niche wholesale, re-export, FMCG, electronics.

Notes: customs/VAT apply when goods enter the UAE mainland; many zones allow “general trading” as a single activity. Prepare supplier lists, product catalogs, and logistics details for banking.

Professional / Service License

Provide services rather than goods.

Best for: consultancy, IT & software, marketing, design, training, repair/maintenance.

Notes: some services need external approvals (e.g., education/health). Banks like to see contracts, scope-of-work documents, and a simple portfolio or website.

Industrial / Manufacturing License

Make, assemble, or process products inside approved facilities.

Best for: light manufacturing, assembly/packaging, food processing, 3PL value-added services.

Notes: requires suitable premises, HSE/municipality clearances, and higher utilities/staffing. Visa capacity scales with space.

E-Commerce License

Sell online via your website or marketplaces.

Best for: D2C brands, cross-border sellers, marketplace storefronts.

Notes: for mainland deliveries, use approved last-mile partners or a mainland setup. Prepare gateway/KYC documents, privacy/returns policies, and VAT compliance.

Documents Required for Dubai Free Zone Company Formation

Getting your paperwork right is the first step toward a smooth company setup. While each Free Zone has its own checklist, most require a core set of documents to approve your license.

Standard Requirements

- Passport copies of all shareholders and directors (valid for at least 6 months).

- Passport-size photos of the applicants, usually with a white background.

- Completed application form provided by the Free Zone authority.

- Proposed trade name choices for initial approval.

Business Activity Support

- Business activity description that clearly explains your products or services.

- Business plan (sometimes required for regulated activities or banking).

- External approvals if your activity falls under special categories such as education, healthcare, or financial services.

Address & Identity

- Proof of address (utility bill or tenancy contract) if requested.

- Visa or entry permit copies for UAE residents applying as shareholders.

After Incorporation

Once your license is issued, you’ll also need to secure:

- Establishment card for immigration services.

- Emirates ID and residency visas for investors and employees.

Tip: Free Zones may return applications with missing or unclear documents, which causes delays. At Gulf Corporate Services, we pre-check and organize every file so your approval comes faster and with fewer obstacles.

Benefits of Establishing in a Free Zone UAE

Beyond ownership and tax advantages, business setup in Dubai Free Zone offers even more perks.

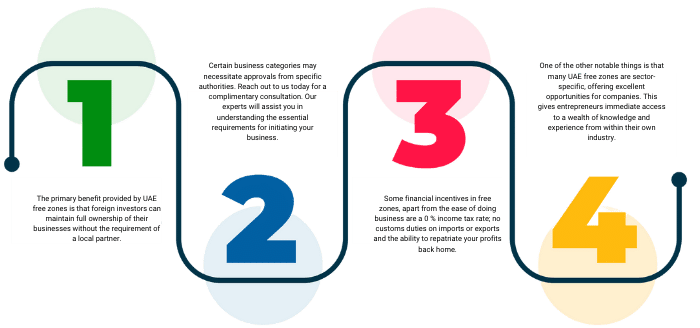

1. Retain Ownership

3. Financial Incentives

2. Business License

4. Sector-Specific

Start Your Free Zone Company in Dubai Today

Starting a Free Zone company in Dubai gives you 100% ownership, fast licensing, and access to global markets. Whether you’re launching a startup or scaling internationally, Dubai’s Free Zones provide the perfect environment for growth. At Gulf Corporate Services, we handle every step, zone selection, licensing, visas, banking, and compliance, so you can focus on building your business.

Frequently Asked Questions About Free Zone Company Setup in Dubai

How much does it cost to set up a Free Zone company in Dubai?

The cost of Free Zone company setup in Dubai starts from around AED 12,500 and can go higher based on the Free Zone, type of license, office space, and visa requirements. Gulf Corporate Services provides tailored packages to match your budget and business needs.

How long does it take to set up a Free Zone company in Dubai?

With Gulf Corporate Services, Free Zone company formation in Dubai can take as little as 3 to 5 working days, depending on the chosen Free Zone and the completeness of your documents.

Can a foreigner own 100% of a Free Zone company in Dubai?

Yes, one of the biggest benefits of Dubai Free Zone company formation is that foreigners can enjoy 100% ownership without needing a local sponsor.

Which Free Zone is best for starting a business in Dubai?

It depends on your business activity. Popular choices include:

- DMCC for trading and commodities

- IFZA for flexible packages

- Dubai Airport Freezone for logistics and aviation Gulf Corporate Services helps you choose the Free Zone that best suits your business goals.

What are the benefits of setting up a Free Zone company in Dubai?

The main benefits include:

- 100% foreign ownership

- Zero corporate tax

- Quick setup process

- Easy access to international markets

- Modern infrastructure and facilities

Gulf Corporate Services ensures you take full advantage of these benefits for your business setup.

Can I get a residence visa with a Free Zone company in Dubai?

Yes, you can. Most Free Zones offer visa packages for investors and employees. Gulf Corporate Services assists with the entire visa process once your company is established.

What types of businesses can be set up in Dubai Free Zones?

Dubai Free Zones accommodate a wide range of businesses, including:

- Trading companies

- Consultancies

- IT services

- Logistics

- Manufacturing units Gulf Corporate Services will guide you in selecting the right license based on your business activity.

Do I need to rent office space in a Free Zone?

Most Free Zones offer flexible options like virtual offices, flexi-desks, or shared workspaces. Gulf Corporate Services will help you choose the best option depending on your budget and company size.

Can I trade within the UAE mainland with a Free Zone license?

Free Zone companies are generally allowed to trade internationally and within their Free Zone. To trade directly with the UAE mainland, you will need a local distributor or open a mainland branch. Gulf Corporate Services can guide you through your options.

Is it mandatory to have an Emirati partner for Free Zone company setup?

No, it is not mandatory. One of the main reasons businesses choose Free Zone company setup in Dubai is the freedom of 100% foreign ownership.